A Discussion of Key Findings from the Latest Finance Shared Services Research Related to Technology and Analytics

In December 2020, ScottMadden’s Brad DeMent and Trey Robinson delivered a webinar to discuss the results of the latest APQC finance shared services benchmarking study. The study was designed by ScottMadden and surveys were administered by APQC over five cycles: Spring/summer 2014; spring/summer 2015; summer/fall 2016; spring/summer 2018; and summer 2020. The scope of the finance shared services study included delivery model, scope of services, staffing, location, performance, and technologies leveraged. Results from 200 organizations from the last two cycles were shared during the webinar.

Drawing from the results of the survey, this article highlights trends in technology and analytics within finance shared service centers (SSCs), encompassing areas including:

- The number of ERPs in use;

- the most commonly-leveraged technologies;

- adoption of robotic process automation (RPA) and intelligent automation (IA); and

- the value and top challenges of IA as an emergent technology.

Access the complete article series here.

Shared Services Technology Trends

Broadly speaking, SSCs are increasingly consolidating their ERPs to realize the benefits of more integrated systems and leveraging a wide range of technologies to optimize high-volume, transactional finance processes like accounts payable. There is still plenty of room for growth, however: Fewer than half of SSCs are leveraging technologies like financial close automation or electronic invoicing, both of which can help drive cost savings and great efficiency.

ERP CONSOLIDATION

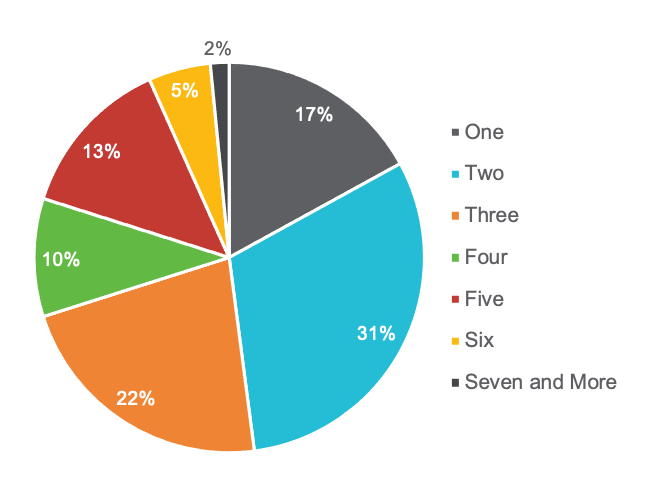

SSCs are increasingly consolidating their ERPs. A majority of organizations (70 percent), for example, report using between 1 and 3 ERPs, while only two percent leverage seven or more (Figure 1). “In the past,” DeMent said, “we’d often run into clients that told us they use 30, 40, or even more ERPs, often accumulated through acquisitions—That’s becoming less and less common.” DeMent offered further insights regarding this finding: “IT organizations typically have an ERP consolidation plan as part of their five-year roadmap. Though best-of-breed ‘layover’ systems offer a solution to connect disparate ERPs and bring functionality to one user interface, this can become complex, expensive, and IT intensive as multiple interfaces have to constantly be developed and unraveled,” said DeMent “Organizations prefer to benefit from both, maximizing the functionality and standardization of one ERP, while going beyond that functionality with a best-of-breed system that might also handle necessary customizations.”

Figure 1: How many ERPs or ERP instances are in use throughout your entire organization?

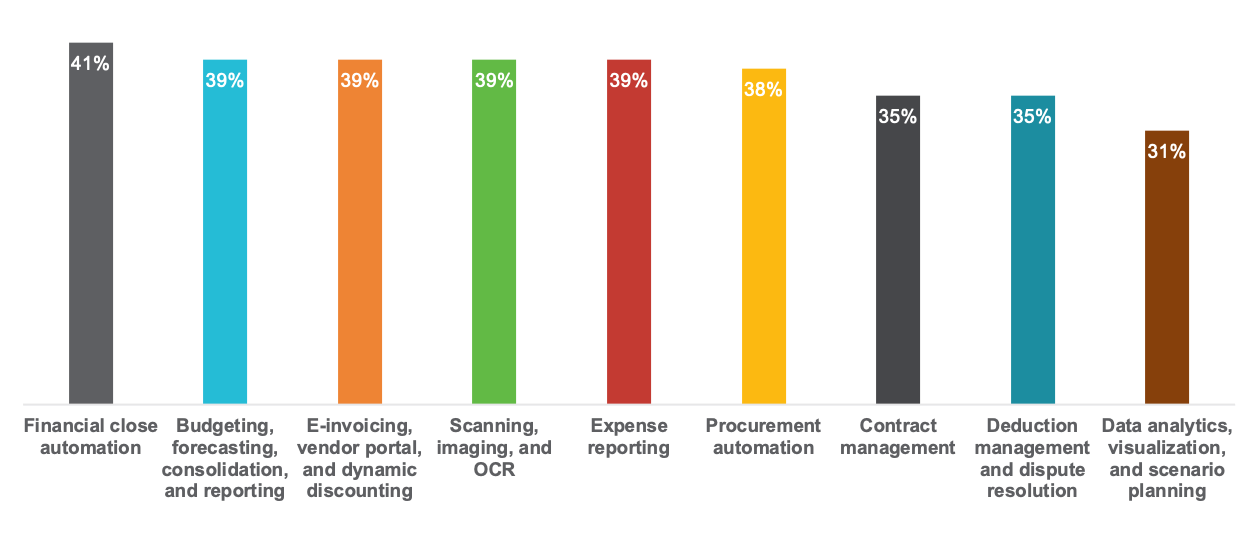

MOST COMMONLY LEVERAGED TECHNOLOGIES

The most popular technologies for respondents are shown in Figure 2 and include tools like financial close automation, budgeting/forecasting tools, and e-invoicing. DeMent said these tools are growing increasingly more sophisticated. For example, many organizations are now embracing advanced optical character recognition (OCR) solutions with embedded AI. “These technologies don’t require templated invoices or ‘human in the loop’ learning but can recognize patterns and know where to go for the right type of information,” DeMent said.

Figure 2: Which types of technologies do you leverage in your finance shared services organization?

RPA and Intelligent Automation Applications

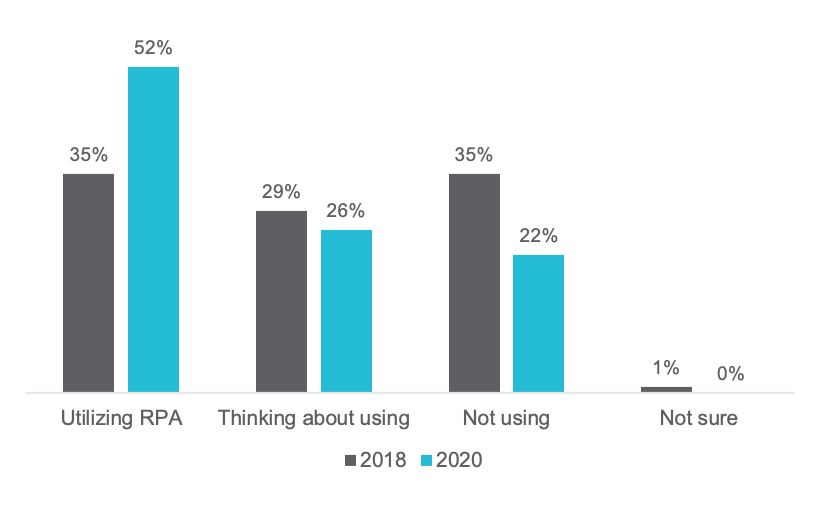

SSCs are increasingly implementing robotic process automation (RPA) and intelligent automation (IA) technologies to help streamline and optimize key finance processes. For example, more than half (52 percent) of 2020’s survey cycle respondents report that they utilize RPA in their shared service centers, compared to 35 percent in 2018. The number of organizations that are still thinking about using these technologies or not using them at all has also decreased (Figure 3). In a similar way, the adoption of IA technologies like chatbots and virtual agents continues to rise—43 percent of organizations in the 2020 survey cycle have now implemented these technologies, compared to 25 percent in 2018.

Figure 3: To what extent does your SSC use RPA?

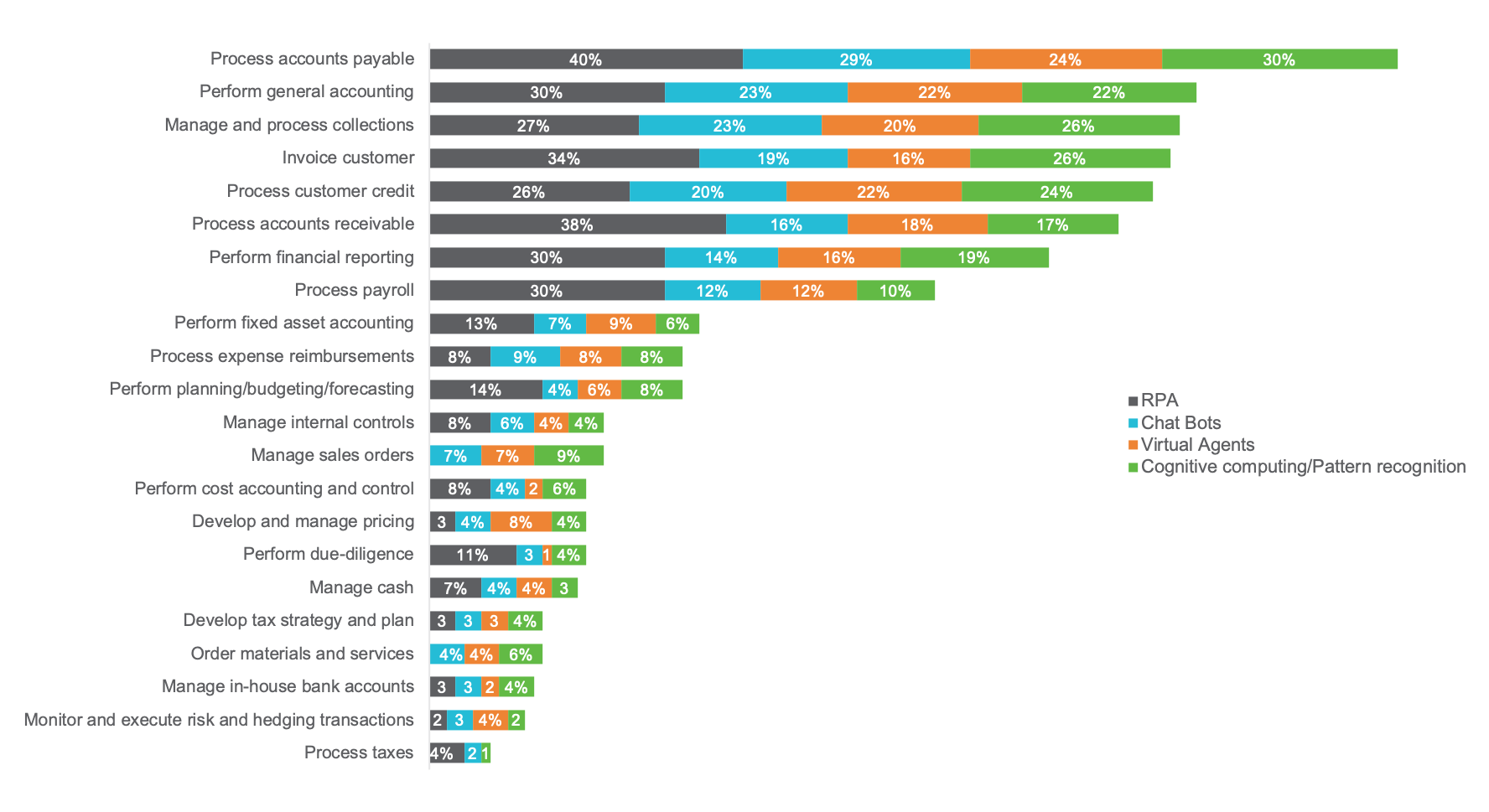

Figure 4 shows the processes to which RPA and IA technologies are most commonly applied and the tools most commonly leveraged for each. DeMent said that for many of these processes “RPA is being outpaced by chat bots, virtual agents, cognitive computing, and pattern recognition, often packaged more nicely and neatly in best-of-breed technology solutions. Organizations are finding RPA alone cannot muscle through most processes end-to-end. When RPA hits a dead end, automation can continue by collecting needed information from customers or subject matter experts with chatbots or virtual agents. As well, AI is not typically being used to make decisions for humans, but is being used to recognize insights and enhance decision making when processes meet a fork in the road.”

Figure 4: For which processes have you applied RPA/chat bots/virtual agents/ cognitive computing/pattern recognition?

INTELLIGENT AUTOMATION—VALUE AND CHALLENGES

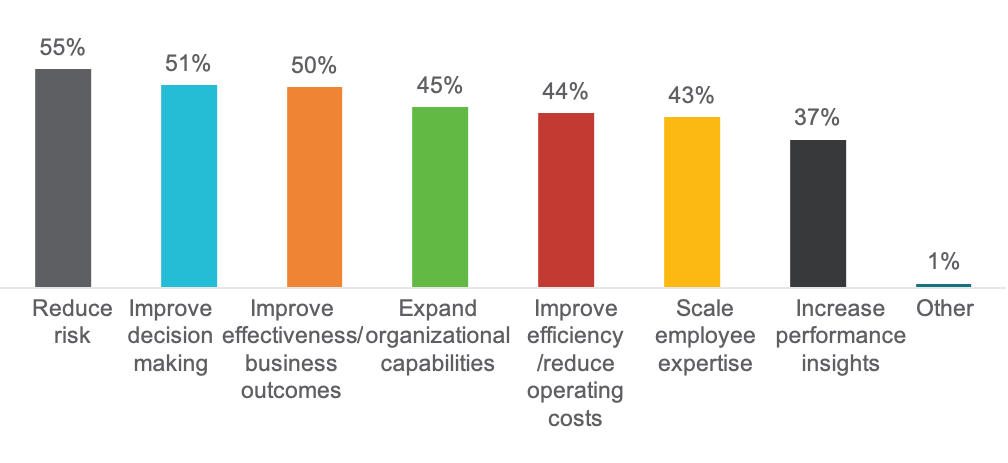

The growing adoption of IA technologies is a product of the value that SSCs derive from the application of chatbots, virtual agents, and other intelligent technologies to key finance processes. Artificial intelligence (AI) or cognitive computing is one type of IA technology. For example, 55 percent of respondents reported that these technologies deliver value to finance processes by reducing risk, 51 percent said they help improve decision making, and 50 percent say they will improve effectiveness or business outcomes (Figure 5).

Figure 5: How could artificial intelligence deliver value to finance processes?

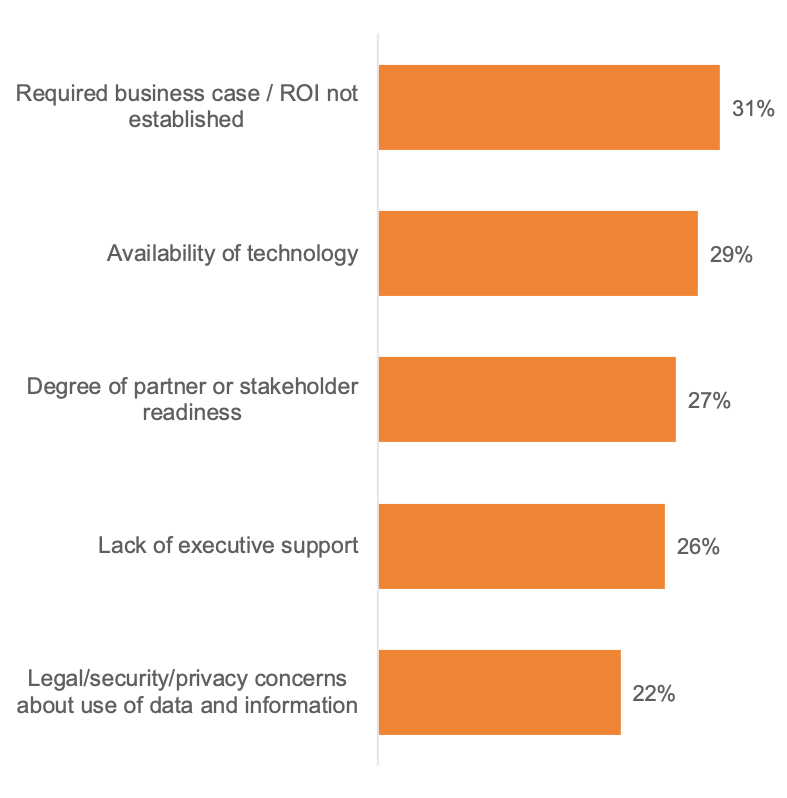

As an emergent technology, AI is not without its challenges. The top challenge, identified by nearly one-third of respondents (31 percent), is the need to build the business case for these technologies. The availability of the technology itself is also a challenge for nearly one-third respondents (Figure 6).

Figure 6: What are your organization’s three main challenges in adopting AI (or cognitive computing) capabilities?

IA technologies are simply not as ubiquitous as RPA at this point, DeMent said. “RPA now comes in a nice, neat box with cellophane wrap, while some of this IA technology is still experimental. Small technology companies are creating IA engines and you’re starting to see it being embedded in best-of-breed packages. Some of it is not widely available, but we suspect we’ll see a continued march and advancement of this technology in best-of-breed solutions and larger providers that are focused on particular aspects of finance processes.”

Conclusion

Technologies like RPA and IA have been game-changers for many SSCs, empowering organizations to streamline and optimize high-volume, transactional finance processes and ultimately serve customers more efficiently. Many organizations still have room for growth when it comes to adopting these technologies, and many continue to struggle with challenges like making the business case that they are worthy of investment. Even so, given the value they deliver, it’s likely adoption will continue to grow as SSCs work to scale their reach and maximize their capabilities.

Study Demographics

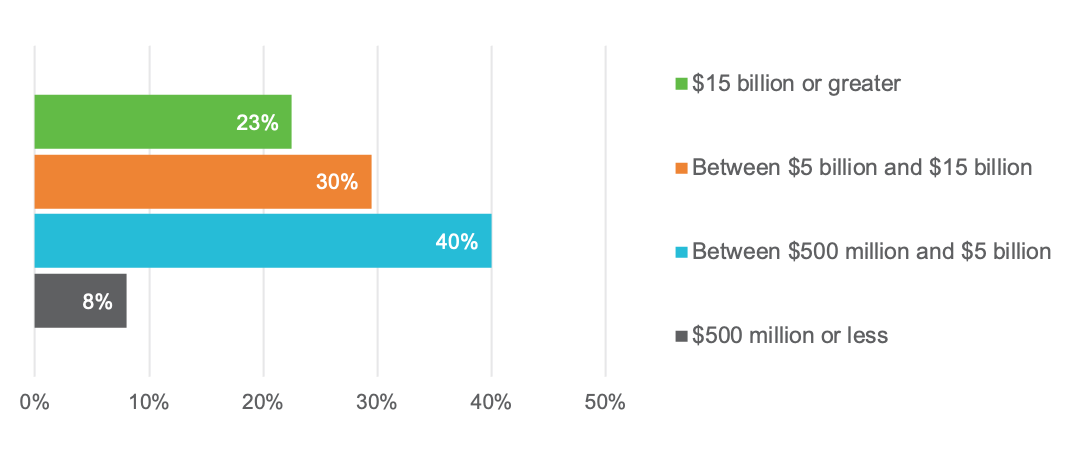

The results summarized represent 200 participating organizations from the US or Canada. Company size is balanced across the revenue profile (Figure 7), with median revenue of $11.9 billion. Most organizations (87 percent) have been operating over three years, and more than half (55 percent) have been operating for over five years.

Study Population: Business Entity Revenue