A Day in the Life of Susan

Susan, a well-respected director at a large multinational luxury retail corporation, walks in on Day 1 of the monthly close process. Susan begins to review a new set of reports that were just run prior to her arrival. The data visualization report shows the validated month-end activity sitting in the distributed ledger, as well as a forecast of the month-end revenue and expenses. Susan turns to her voice-enabled smart agent, “Can you provide me with a month-end projection using the neural networks forecasting technique? The tariff impact has been in place for nearly a month, and I have a feeling that our sales revenue from the Asia region will be significantly impacted.” She shifts to review her robotics algorithm, which automatically cross-checks monthly T&E submissions against the company-wide T&E policies. Susan is less concerned about fraudulent transactions, since blockchain helps prevent dishonest activities. However, she wants to ensure that the interlocking systems using blockchain have an added layer of security to protect against potential fraud.

Susan has the experience to be a well-versed Chief Information Officer (CIO), except that she’s not the CIO nor does she solely work in the technology department. Susan is a director within the finance division and has developed the reputation of being a high-performing financier and a competent technologist.

Gone are the days of the Excel-crunching, business-calculator-carrying finance employee. Instead, the future finance professional will possess a skillset similar to Susan’s. Companies in industries ranging from consumer electronics to financial services are seeking more technology-savvy finance professionals as technology is becoming an essential component of our everyday lives.

In this article, we examine what’s driving the evolution of the finance skillset and four key skills that are important for future finance professionals: advanced analytics, expanded risk management, strategic problem solving, and communication and influence (see Figure 1).

Figure 1: Four Key Skills for Future Finance Professionals

Transactional Finance Skills Will Become Dormant

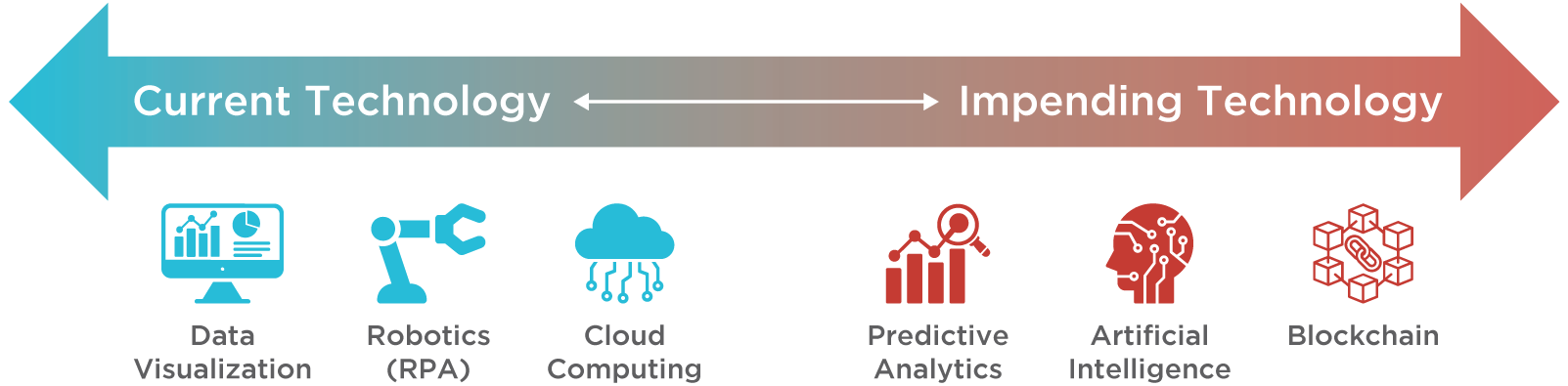

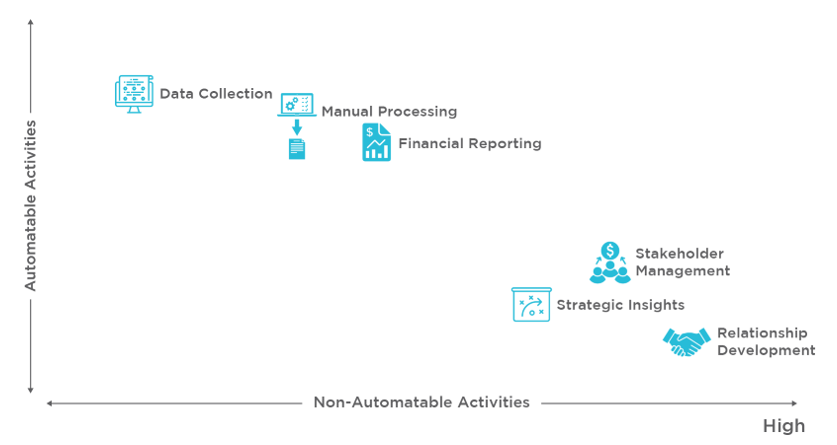

As depicted in Figure 2, there are numerous disruptive technologies that will continue to impact the finance function. Advanced technologies, such as robotic process automation (RPA), artificial intelligence (AI), and blockchain, offer finance professionals an opportunity to replace labor-intensive financial reporting activities with more strategic high-value-add initiatives. A month-end close contains a series of highly routine accounting transactions, such as basic journal entries, reconciliations, audits, and standard management reports. Manual monthly close processes, basic budgeting, and standard reporting activities represent just a small portion of the routine and rudimentary finance activities that will inevitably become automated (see Figure 3). For example, RPA and advanced AI technologies can automate manual accounting processes, process transactional data from disparate finance systems, and eliminate the manual creation of key standardized financial reports. As a result, we believe that future finance professionals will spend less time performing routine audits and reconciliations and more time performing advanced analytics and partnering with smart technologies.

Advanced Analytics and Finance

Look on any finance job board, and you will see job titles such as budget analyst or senior financial analyst. In the future, however, finance roles will have titles such as bot supervisor and analytics scientist. Organizations are conglomerates of information, and the value proposition that finance professionals provide is their ability to generate insights about that information. As millennials become a larger percentage of the workforce, there will be less interest in manual, repetitive work and more interest in advanced analytics. The language of business will evolve beyond accounting as advanced technologies reconcile basic debits and credits and allow finance professionals to focus on the key strategic decisions.

For example, historically, a financial analyst would manually upload journal entries to the ledger, process data for the divisions’ intercompany transfers, and create a series of Excel-based financial reports and reconciliations during the monthly close process. In the future, that financial analyst will spend her month end updating an algorithm to account for a competitor’s recent change in pricing and assess the impact on monthly revenue projections. Or she could partner with the technology function to integrate a recent acquisition with the intercompany blockchain. The future finance professional must have the analytical and technological skills to solve the problems of the future.

Risk Management in Finance

With the advancement of technology comes the need for additional risk prevention measures. Future finance professionals will be required to have more knowledge of security and compliance beyond the scope of typical financial measurement. While common financial knowledge, such as understanding liquidity risk for a treasury function or mastering Sarbanes Oxley for a financial reporting role, will still hold true, financial risk will extend beyond these basic elements. For example, the distributed validation process of blockchain, along with its cryptographic language, significantly reduces the occurrence of fraudulent transactions. While detailed blockchain knowledge may not be the requirement, finance professionals at all levels must be cognizant of the potential risks of advanced technology. In addition, finance professions must be able to have relevant conversations with IT to anticipate and solve any potential fraudulent financial transactions.

The Need for Strategic Problem Solving

As finance becomes an integral business partner, strategic problem-solving skills will continue to become a priority for finance professionals. In addition, technology automation will reduce the size of the typical finance back-office function. According to a Gartner study, “By 2020, robotic process automation will eliminate 20% of non-value-added tasks within the office of finance.” As a result, finance employees who can establish themselves as strategic partners, rather than typical “bean counters,” will be invaluable to the organization.

Finance employees of the past became adept at waiting until the end of the month to extract raw data from ERP systems, create Excel-based financial reports, and provide variance analysis numbers and percentages on month-over-month or year-over-year transactions. The finance partner of the future will no longer just provide basic financial reporting. He or she will provide real-time guidance that will allow the business to proactively address any potential variances before the close process. The future finance employee will also assist in the development of market strategies to combat any adverse market occurrences and proactively adjust go-to-market strategies. By mastering financial and non-financial issues and performance measures, finance partners will be able to convey fresh insights to their business customers within the organization.

Finance Communication Evolves

Lastly, as millennials become a larger part of the workforce, they will inevitably bring their text-heavy communication styles to the organizations they support. By the year 2020, communication and support between the finance function and its internal customers will become increasingly more automated. Finance professionals of the future will no longer just serve as the intermediary between their business customers and the salient data that drives key strategic decisions. As internal customers refrain from picking up the telephone to address common reporting requests, smart agents and self-service portals will replace manually created Excel spreadsheets and personal phone calls.

Successful finance professionals will add true value to their organizations by deriving and communicating key strategic insights rather than merely facilitating the flow of financial information. Understanding key stakeholders and creating a coherent message out of esoteric and ubiquitous data are two communication skills that will become essential for future finance professionals. Technology will expedite the production of repetitive analogous tasks. With this comes the opportunity for finance professionals to create and communicate compelling business stories for their stakeholders. Tools such as Tableau can help create an aesthetically appealing presentation. However, it’s up to the finance professional to understand who the key stakeholders are and deliver a tailored message that will align interests of the respective business leaders with the goals of the overall organization.

Conclusion

Technology will continue to automate many of the routine tasks of the past and empower finance professionals to become more efficient and productive. As technology continues to evolve, organizations will look to their finance professionals to produce higher-quality data and provide key insights that will drive strategy and improve financial results. One key aspect that cannot be lost in this era of rapid technology change is the people. Technology is not about replacing the people, but replacing the processes that will enable workers to perform their jobs more efficiently and effectively. Effective change comes from the harmonization of technology and people as organizations prepare for a future workforce supported by digital technology. Setting up a finance innovation lab where existing employees can learn the skills of the future or test drive new technology platforms is an example of how companies can successfully navigate the impending changes. Change can be scary and the better an organization can prepare its employees for the new skills needed, the more successful they will be in adopting disruptive technology.

Sources:

- JP Morgan’s Requirement for New Staff: Coding Lessons – Financial Times

- Changing Technology and Finance – Chartered Global Management Accountant

- Emerging Technologies and the Finance Function – Association of Finance Professionals

- When and How to Use Robotic Process Automation in Finance and Accounting – Gartner

- Uber Proposals Value Company at $120B in a Possible IPO – WSJ

Additional Contributing Author: Nick McCalop