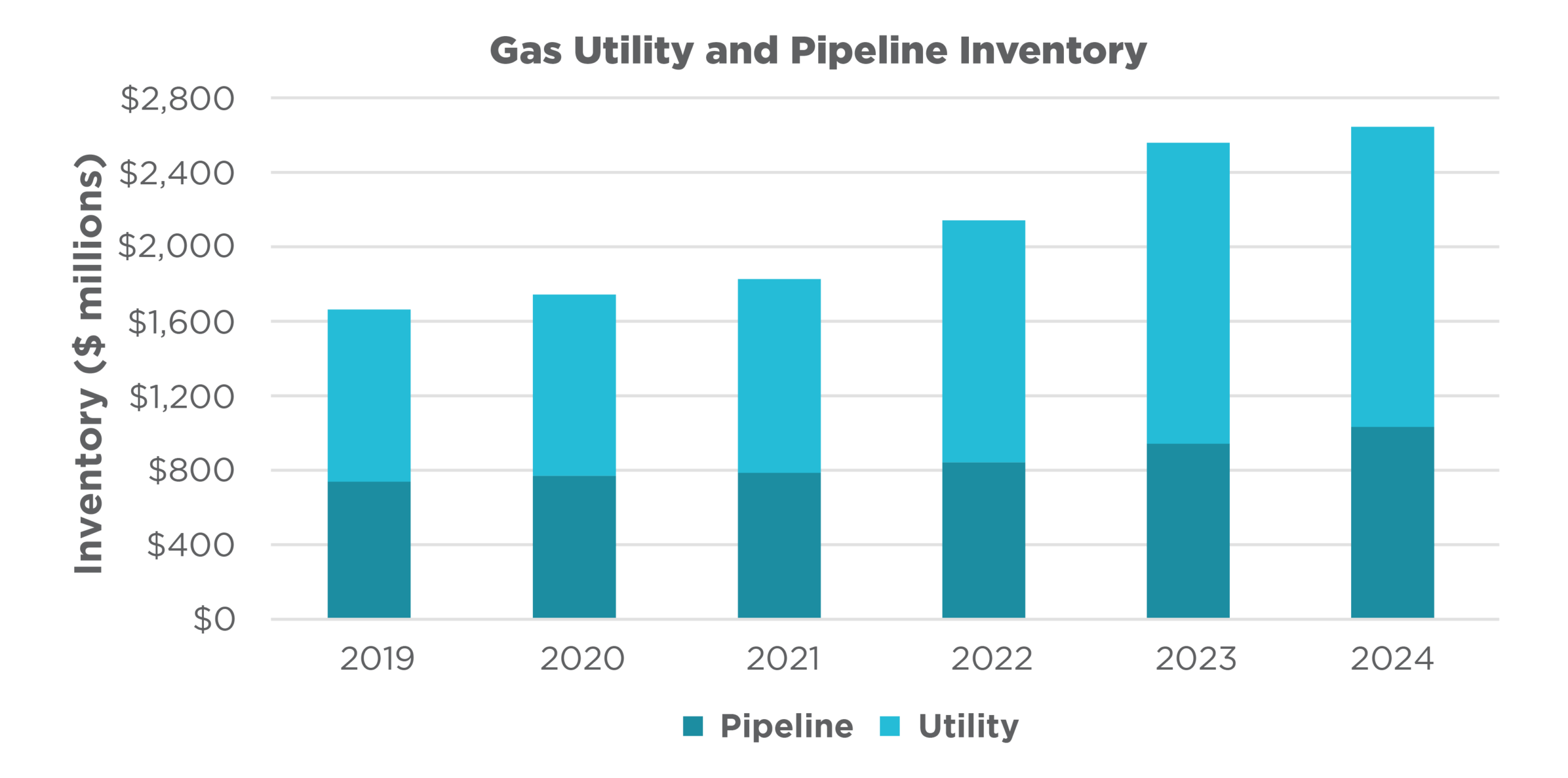

Total inventory levels in the natural gas industry have risen sharply over the four–year period from 2019 to 2024. Inventory reflects total materials and supplies, as reported in FERC 154. An analysis of gas utility and pipeline companies reveals a 60% increase in inventory since 2019, reflecting an annualized growth rate of about 11%.

While inflation is a contributor to rising inventories, as evidenced by a 5% annual growth rate of the Producer Price Index for Utilities between 2019 and 2024, it only tells part of the story.

Case Study

While working with a client to analyze their inventory trends, we identified a nominal annual growth rate of nearly 19% in their transmission and distribution inventory over six years. After adjusting for inflation, the real growth rate was still elevated, at 15% per year, highlighting that only 4% of the growth was due to inflation. This insight helped the client separate true physical inventory growth from the inflationary effects.

In our experience, much of the inventory growth stems from physical buildups of material, often as a response to supply chain disruptions and extended lead times. Compounding this practice, traditional inventory management challenges, such as manual processes, inconsistent standards, and outdated systems, influence decisions to maintain higher stock levels. Also, a systemic industry issue amplifies these challenges; most companies do not leverage analytics to underpin a risk-informed approach for inventory management. A common result is that inventories have too little of stock that is really needed and too much of what is not.

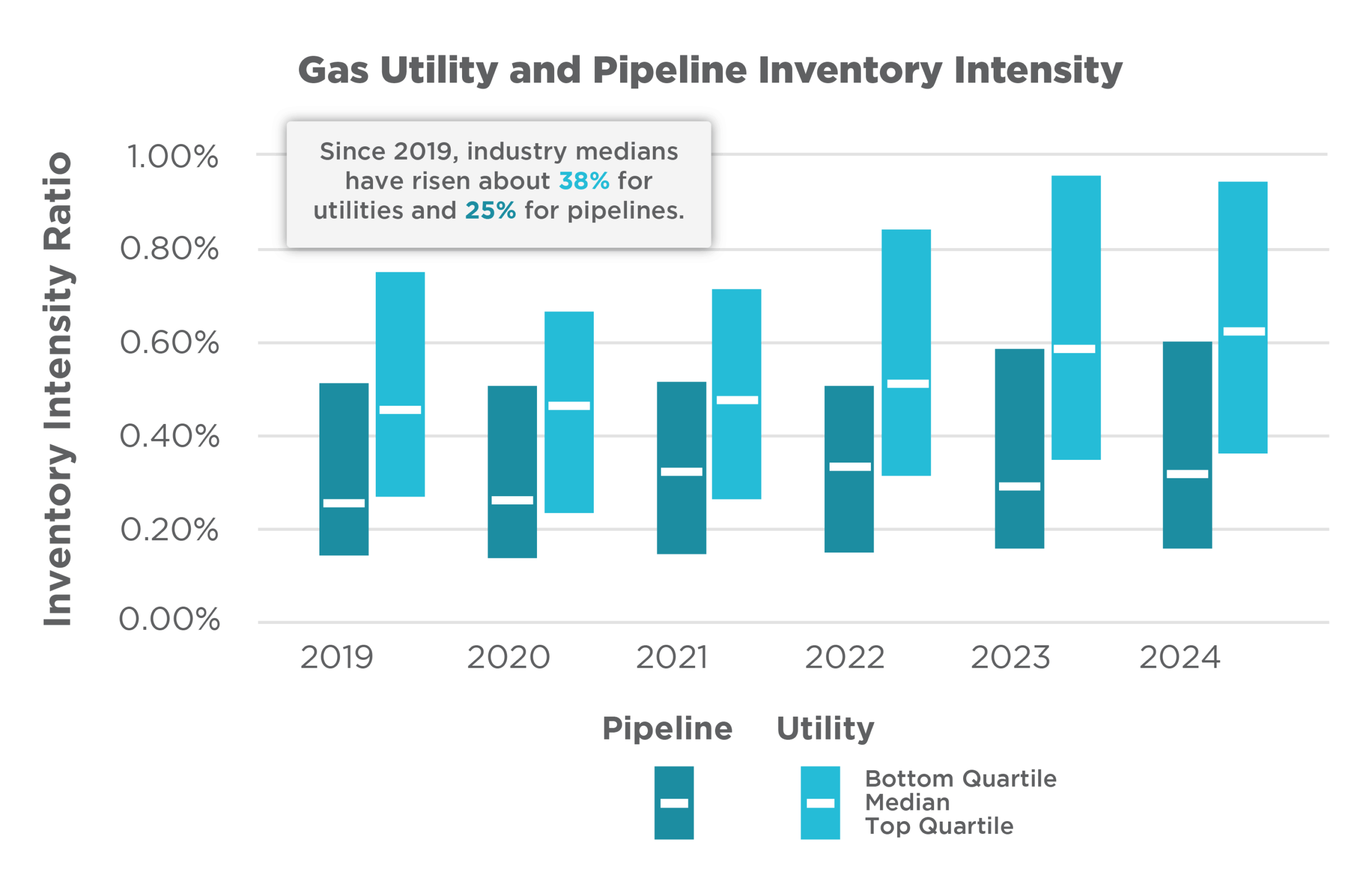

Inventory Intensity

Inventory intensity considers how a company is using inventory to support its capital assets and is a way to capture how inventory levels are moving relative to system growth. This metric is the ratio of inventory a company holds as a percentage of its (end of year) plant in service. The below chart shows inventory intensity for gas utilities and pipeline companies from 2019 to 2024.

As with total inventory, inventory intensity in the gas industry increased during this period, especially for utilities. Since 2019, this measure has increased 38% for gas utilities and 25% for pipeline companies, indicating that growth in inventory is outpacing the rate of system (i.e., plant in service) investments.

Gas utilities serve customers with wide-ranging requirements for delivery pressure and volume, through distribution systems of varying ages, materials, and sizes, and across diverse service territories. Relative to pipeline companies, utilities’ more complex system compositions and customer bases require higher levels of inventory to support operations. Differences in system, customer, and location attributes drive differences in inventory levels across utilities, as well.

Higher inventory levels create challenges for supply chain organizations. For example, surplus inventory drives up carrying costs, which include expenses such as leases, financing, insurance, and tax. According to the Annual State of Logistics by the Council for Supply Chain Management Professionals, typical carrying costs can be 14% to 20% of inventory value, so excess inventory can be a significant financial burden for many gas utilities and pipelines. Other common issues include impacts to service levels and constrained storage facilities.

How ScottMadden Can Help

To mitigate the impacts of rapid inventory growth, ScottMadden offers a range of tailored solutions that help supply chain organizations improve their inventory management practices:

- Materials Management Assessment: We conduct in-depth assessments across inventory, materials, and warehouse management to identify performance gaps and high-priority improvement opportunities. We leverage proven methodologies, including leading practice assessments, performance benchmarking analyses, and evaluations of functional effectiveness to provide actionable recommendations for your organization.

- OptiStock Inventory Optimization Solution: We use detailed usage patterns, service level requirements, and recent lead time data to determine appropriate inventory settings for every item in stock. Our solution provides a data-driven approach to inventory management that aligns with the unique needs of energy companies.

- SpareLogic Solution: We identify the parts and materials required to form your emergency stock. Our solution uses advanced statistical analysis and artificial intelligence to help identify critical spares and set service levels across all spare parts inventory. It ensures that parts are properly prioritized to enable more optimized levels and support reliability requirements.

- LeadAhead Planner: This tool facilitates the identification of SKU-level demand at the earliest stages of the project lifecycle, addressing the need for early demand capture. It aligns project planning and delivery timelines with the realities of current lead times, enabling more effective and efficient project execution.

- Gas Local Distribution Company Peer Analytics: This tool is a benchmarking platform that provides comprehensive peer analytics for U.S. gas local distribution companies (LDCs), offering over 1,900 metrics and 2.4 million datapoints across financial, system, customer, organizational, and performance categories. It allows users to compare their LDC’s performance against 200+ peers, identify top performers, and explore improvement opportunities.

The rapid growth in inventory levels presents challenges for the energy industry. However, through strategic inventory management, companies can effectively manage this landscape and design for the future. ScottMadden’s comprehensive suite of services, from comprehensive assessments to advanced optimization tools empowers organizations to achieve operational excellence through decreased operating costs, improved service levels, and mitigation against uncertain futures. To learn more about how ScottMadden can support your inventory management strategy, contact us today or check out the content below for more insights.

Henry Fumbah also contributed to this article.