How to Prepare an Acquisition for Scale and Boost Value in the Private Equity Industry

Introduction

As a private equity firm, you need to find value in your transactions as quickly as possible. Your firm recently acquired a new portfolio company, and the typical issues are there once again:

- Lack of rigor in forecasting; systems stretched to their limits

- Immature processes

- Lack of actionable Key Performance Indicators (KPIs)

You knew it would take effort to scale the business, but it ended up not being as ready as the founders stressed during due diligence. Where should you direct capital and incentivize the executive team to grow EBITDA and build momentum for future margin expansion? The impact of inflation and higher interest rates necessitates a return to fundamentals and organic growth versus increasing multiples. The best-positioned firms identify “quick wins” that require minimal time and expense to implement. Further, leading practice would tailor a prioritized list for organically improving operations—cash transparency, process harmonization and standardization, elimination of redundancy, technology upgrades, and much more.

There is a wealth of opportunity for private equity firms that leverage their resources in the areas that will yield the greatest returns to EBITDA.

Building a Plan to Drive Growth

There are limits to the clarity you will achieve during due diligence. Post-close is where you uncover the true health of the business. Our experience shows that at least one (and more commonly multiple) of the following factors will be an issue:

- Functional area(s) lack process maturity and need attention

- A core system is absent or overextended (e.g., enterprise resource planning, human resources information system, customer relationship management, order management, warehouse management system)

- KPIs are not aligned with margin expansion and/or are not transparent to the business

- The executive leadership team lacks the will or the skill to take the company to the next level

The challenge is that the areas of opportunity will be different for every new acquisition, and standardized playbooks will yield inconsistent results. There is a need to quickly assess the health of the company, identify quick wins, and to prioritize initiatives that drive organic EBITDA growth.

The priority should be to assess the current state of the business—review collected data and documentation then interview stakeholders and observe processes. The data and documentation typically provide an objective view of organizational performance, while stakeholder interviews provide context and insight into the why.

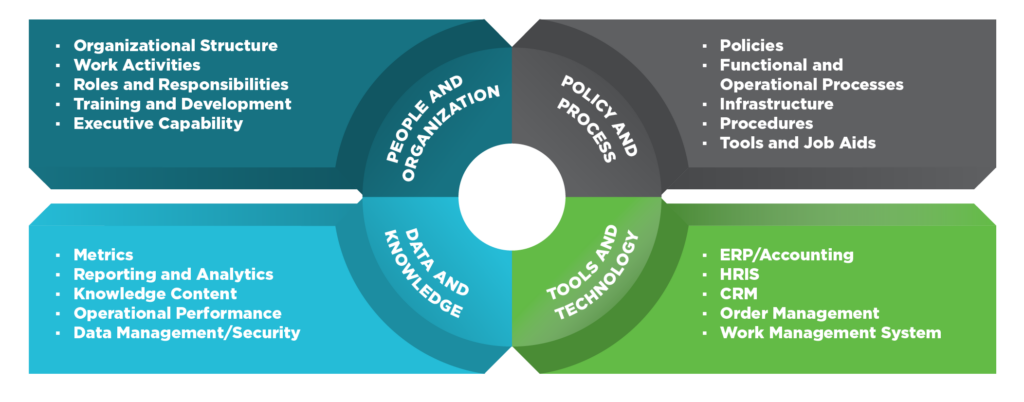

The contrast between what should be happening with how the business is operating is important to understand. The areas that need to be included in the assessment are People and Organization, Policy and Process, Data and Knowledge, and Tools and Technology, as shown in the figure below.

The insights from the assessment of the business can be leveraged to develop a list of gaps that may need to be addressed; it is important to quantify the potential opportunity realized by closing each. Comparison to leading practices and benchmarks can help inform what kind of improvement is possible. Once quantified, a comprehensive business case that weighs dimensions, such as cost, benefits, time, and risk, will inform the quick wins as well as the highest return gaps to close. Frameworks highlighting objectives and key results can help the leadership team prioritize high-impact initiatives. By identifying tactics that have a high impact but require less time and effort to implement, the leadership team can place them at the top of the to-do list and more efficiently improve the business outlook of the portfolio company.

The assessment and prioritization steps are important to get a new portfolio company off on the right track. As seen in the example above, the prioritization should compare 1) initiative complexity measured in a) cost, b) resources to implement, and c) change impact versus and 2) initiative benefit measured in a) savings generated, b) service improvement, and c) control improvement.

Quick wins with low complexity and high benefit are an ideal way to build positive momentum in EBITDA growth that is reassuring for investors and confidence-building for the executive team. The firms that skip this prioritization step may incur unnecessary risks. Transformational projects can be capital-intensive and require months or years before yielding positive results. The prioritization produces a vetted improvement roadmap that the company leadership can own. The increase in enterprise value can quickly be an order of magnitude larger than the upfront investment in time and money to complete it.

Conclusion

The most critical thing you can do with a new portfolio company is to grow EBITDA. A one-size-fits-all playbook applied to every acquisition will yield varying results. Leading firms will assess the business and identify opportunities to swiftly improve performance that builds leadership and investor confidence. They will also tailor their approach to invest resources in the areas that should yield the greatest return. In an evolving economic landscape, it will be essential for firms to provide their portfolio companies with tailored strategies focused on “quick wins” to organically grow EBITDA.