Are you wondering how New York’s Reforming the Energy Vision (NY REV) proceedings will impact the market for energy storage? ScottMadden moderated a panel on the “Role of Energy Storage in the NY Market” at the Infocast NY REV conference July 28-29, 2015, in New York City. Although NY REV continues to evolve, panelists felt strongly that storage will play a key role in the New York market due to its various applications and value streams. This paper highlights some of the key learnings of this panel and contrasts the NY REV regulatory approach to storage with that of other states.

Are you wondering how New York’s Reforming the Energy Vision (NY REV) proceedings will impact the market for energy storage? ScottMadden moderated a panel on the “Role of Energy Storage in the NY Market” at the Infocast NY REV conference July 28-29, 2015, in New York City. Although NY REV continues to evolve, panelists felt strongly that storage will play a key role in the New York market due to its various applications and value streams. This paper highlights some of the key learnings of this panel and contrasts the NY REV regulatory approach to storage with that of other states.

As in many other states, increased penetration of intermittent generation and a growing appetite for grid modernization has improved the value proposition of energy storage technologies in New York. This improvement to the value proposition has been driven by a greater understanding of storage’s key grid applications, including shaping and balancing load, improving resiliency and reliability, and deferring T&D investment. Energy storage is an important component of NY REV, and technologies such as advanced batteries, ultracapacitors, fuel cells, and control modules could play a role in multiple aspects of REV-related projects and initiatives. While New York has no current plans to introduce RPS carve-outs, mandates, incentives, or other subsidies directly related to storage output, there are many ongoing initiatives related to REV which could have a second order effect of driving growth in energy storage in New York State. Specific proceedings and orders related to REV focusing on microgrids and community net metering could certainly provide opportunities for storage to be integrated into projects driven by those initiatives.

Additionally, REV-mandated demonstration projects and concerted efforts to defer investment in system upgrades with non-wires alternatives both have the potential to include storage as a major component.

From the utility’s perspective, questions remain regarding the ownership models and applications for storage that will emerge from REV initiatives. One of the most important components in ensuring successful growth of energy storage within the context of NY REV will be finding alignment between utility benefit and customer benefit. That alignment could manifest through a variety of scale, ownership, and control scenarios. In general, the New York Public Service Commission (PSC) has made clear through various REV orders and proceedings that utility ownership of Distributed Energy Resources (DER) would be prohibited barring a few specific exceptions. DER in this case is considered to be distributed generation, storage used for economic purposes, and customer-side demand management. However, the exceptions outlined by the New York PSC could prove to be favorable to utility-owned energy storage as a DER. Exceptions include the following circumstances:

Examples of Allowed Utility Ownership of DER under NY REV

- Procurement of DER has been solicited to meet a system need, and a utility has demonstrated that competitive alternatives proposed by non-utility parties are clearly inadequate or more costly than a traditional utility infrastructure alternative

- A project consists of energy storage integrated into distribution system architecture

- A project will enable low- or moderate-income residential customers to benefit from DER where markets are not likely to satisfy the need

- A project is being sponsored for demonstration purposes

Looking more broadly, there is no “one-size-fits-all” storage policy for each state. In New York State, the New York State Energy Research and Development Authority will fund seven New York companies to either scale up projects or demonstrate how energy storage can help transform the state’s electric grid.

Looking more broadly, there is no “one-size-fits-all” storage policy for each state. In New York State, the New York State Energy Research and Development Authority will fund seven New York companies to either scale up projects or demonstrate how energy storage can help transform the state’s electric grid.

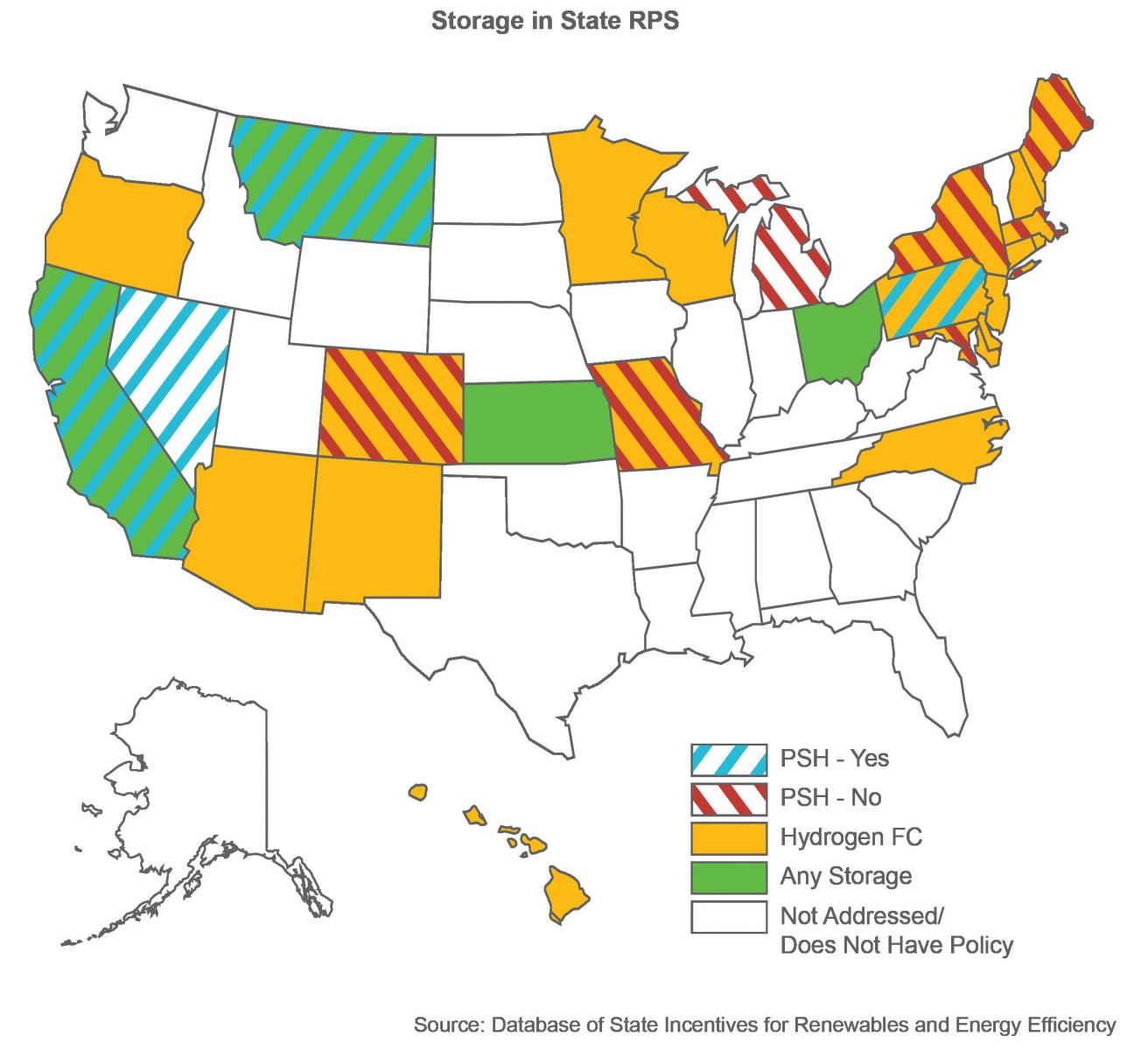

There is certainly not much consistency in policies to encourage energy storage across different states though. Despite significant moves to encourage the development of storage in states such as in California, where energy storage targets have been mandated, many states continue to question not only what policy actions should be taken to encourage the development of storage, but whether any steps should be taken at all. As a result, policies vary across states, with some states opting for specific mandates (California) and others (New Jersey, Hawaii, Texas) using direct cost-recovery mechanisms to incentivize growth. Others, like Connecticut, have opted to fund demonstration projects that are geared at both integrating renewables and improving grid resiliency, similar to REV-related initiatives in New York. Still, although costs of storage are growing increasingly competitive, many state legislatures and regulatory bodies continue to push for additional incentives to further drive growth.

Regardless of the inconsistent policies toward energy storage across states, the recent and projected drops in storage costs and increased storage procurement by utilities seem to indicate that storage will play a growing role in the United States’ energy generation and distribution systems in the years to come. Furthermore, considering the various aspects of New York’s REV initiative that both directly and indirectly encourage the inclusion of energy storage, it seems clear that storage will play an integral part in NY REV implementation as well, regardless of the ownership model.

References

- http://www.cesa.org/assets/2014-Files/CESA-Energy-Storage-and-RPS-Holt-June2014.pdf

- http://www.dsireusa.org/

- http://www3.dps.ny.gov/W/PSCWeb.nsf/All/CC4F2EFA3A23551585257DEA007DCFE2?OpenDocument

- http://www.utilitydive.com/news/new-york-funds-7-energy-storage-projects-for-rev-initiative/400064/

- http://documents.dps.ny.gov/public/Common/ViewDoc.aspx?DocRefId={0B599D87-445B-4197-9815-24C27623A6A0}

- http://documents.dps.ny.gov/public/Common/ViewDoc.aspx?DocRefId={76520435-25ED-4B84-8477-6433CE88DA86}

- http://arena.gov.au/files/2015/07/AECOM-Energy-Storage-Study.pdf

Additional Contributing Author: Josh Kmiec