Introduction

The electrification of the transportation sector will present utilities with both great challenges and great opportunities. However, much of the early attention around electric vehicles (EVs) has focused on light-duty passenger vehicles and the development of public charging. While there will be more passenger EVs on the road in total, the impact that commercial and government fleets will have on utilities will be much more significant and will require dedicated attention to avoid pitfalls and maximize opportunities to serve what will become a new class of electric customer.

The transition of the transportation industry from liquid fuels, such as gasoline and diesel, to battery and fuel cell EVs will cause electric utilities to compete with traditional oil and gas companies as the fuel providers of choice for the transportation industry. Utilities, with an obligation to serve, will come under increasing responsibility to serve significantly higher—and more variable—loads. As private and government fleets migrate to EVs, utilities will be confronted with the challenge of serving these new loads, but they will also have an opportunity to benefit from facilitating the electric transition of fleets.

Why Fleets Matter to Electric Utilities

Although much of the early EV focus has been on consumer adoption and public-charging infrastructure, fleets will likely be the first to electrify in large numbers. Reasons include:

- Increasing federal, state, and local regulations of internal combustion engine (ICE) vehicles

- Introducing new commercial EV models

- Advancing EV technology and falling battery prices

- Incorporating lower-operating and maintenance costs into business cases justifying EV investment

- Providing predictable, return-to-base duty cycles for the best fit for current EV capabilities

- Focusing on corporate sustainability goals, including decarbonization of business operations, and addressing climate change

For these reasons, fleets are expected to quickly overtake the EV adoption rates of residential customers. In addition, a fleet’s decision to electrify can result in large numbers of new EVs being added quickly to a utility’s service territory. For utilities, this puts focus on the need to ensure the right infrastructure is in place to meet customers’ needs. Electrification of fleets will require utilities to develop new models of customer engagement based on these customers’ needs for feedback on cost structure and operations. The engagement and planning process will also be vital to ensuring that the development of charging infrastructure does not lead to increased costs to ratepayers.

EV Fleets Will Significantly Impact Utilities

Fleets, such as those for waste collection, school buses, and package delivery, operate in nearly every zip code in the country. As these fleets begin to electrify, charging at depots and other centralized facilities can serve to concentrate large EV-charging loads. If charging cycles are not carefully planned and managed, electrified fleets will have the potential to place substantial demand on local electric distribution systems at critical peak times.

However, fleets may be able to mitigate these impacts through careful planning. By selecting duty cycles suited to EVs and staggering vehicle charging, vehicle energy consumption may be lowered and charging spread over more hours per day, reducing energy needed per vehicle, required charger size, and total demand.

Questions utilities should ask when electrifying a fleet include:

- How is the fleet calculating its charging demand? What assumptions are being used?

- What types of chargers are being installed? What factors drove the decision?

- Has the fleet considered modifying duty cycles or charger types to lower costs?

- Is the distribution system sized to accommodate concentrated charging needs?

- If upgrades are needed, who will pay for the costs?

- How will rate structures evolve to meet the commercial EV fleet need?

- Can managed charging be used to mitigate peak-load impacts?

- What opportunities exist to assist fleets in planning their energy needs?

Engagement Opportunities for Electric Utilities and Fleet Operators

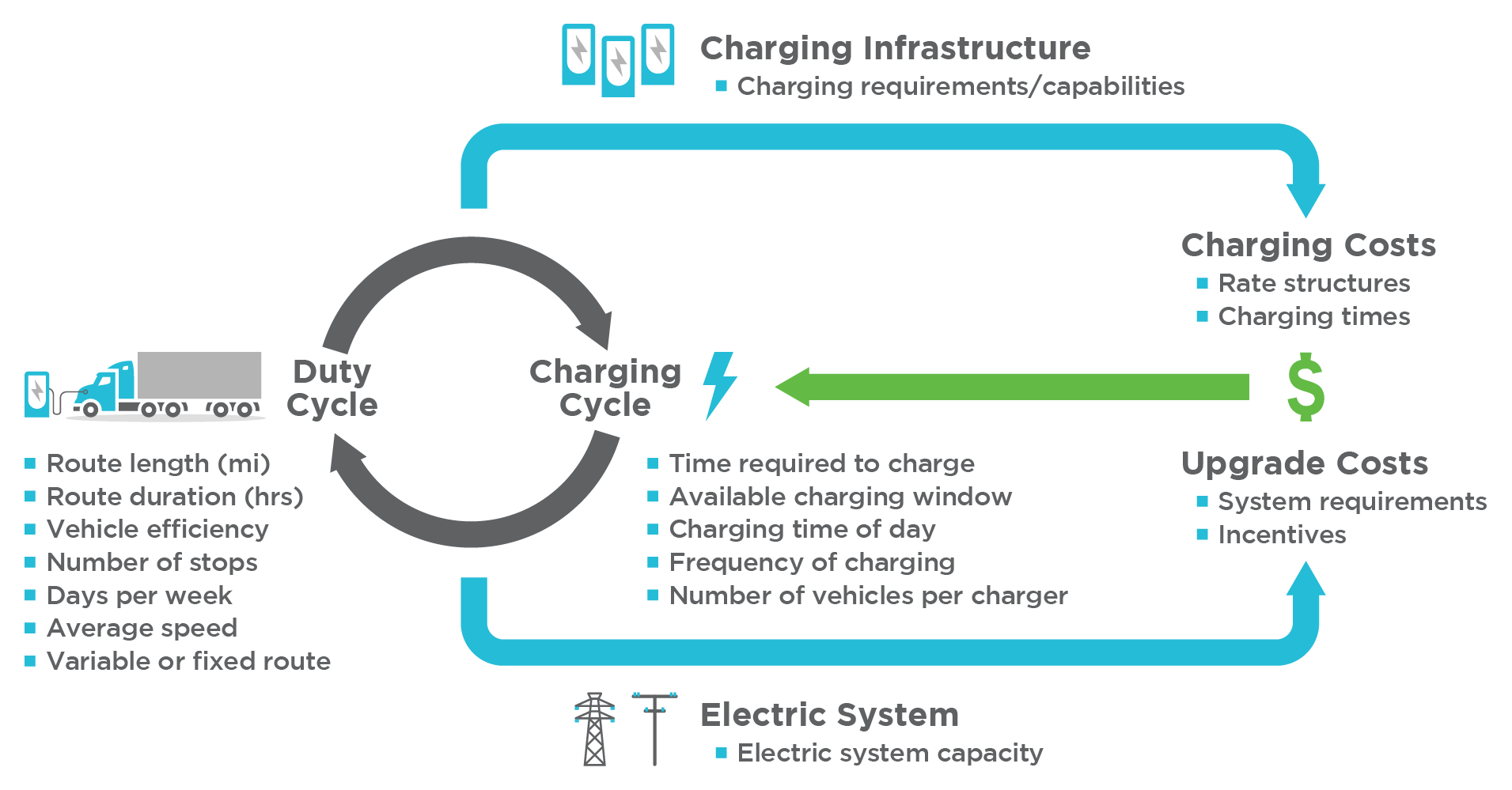

Electric fleets, unlike traditional loads, will have flexible demand that will be determined by the way in which vehicles are operated (duty cycle) and how they are charged (charging cycle). As a result, the size of both the initial-charging infrastructure investment and ongoing charging expense will be dependent on how fleets are planned for and operated, creating an opportunity for utilities to work with fleets to right-size infrastructure and manage costs.

Figure 1: Fleet Electrification Cost Drivers

Engaging with fleet operators early is critical to understanding and informing their electrification plans. By working with fleet managers, utilities can provide information regarding infrastructure costs, including potential grid upgrades and cost of charging to provide fleets the information needed to plan for electrification.

Other ways utilities can engage fleets include:

- Conducting distribution system analysis to assess the ability of the distribution system at the customer’s location to accommodate the charging load

- Sharing information about areas on the distribution system with higher capacity and potentially lower costs to interconnect may serve the customer’s needs

- Performing rate analyses to support fleets’ modeling of total cost of ownership

- Providing charging-optimization guidance to educate fleets on the costs they may incur, depending on usage and time of day, and how to implement best practices to manage charging costs

- Educating fleets on how flexible duty cycles and other factors may create opportunities to right-size chargers to find the optimal balance between infrastructure costs, physical space, and charging capabilities

Why Now Is the Time to Engage Fleet Customers

Fleet electrification is being driven, in large part, by fleets themselves. The availability of commercial EV models is growing rapidly with more than 80 light-duty EVs planned for 2022 and more than 50 medium- and heavy-duty EVs on the market today. In addition, there are efforts in California and New Jersey to limit the sale of ICE vehicles beginning in 2035, and similar legislation has been proposed in Washington state beginning in 2030.[1] Electrification announcements made by major U.S. fleets (see sidebar) will accelerate demand resulting in the widespread deployment of electric fleet vehicles over the next 5 to 10 years.

Due to existing regulatory processes and the long lead times needed to plan for additional electric system capacity, it is essential that infrastructure planning for fleet electrification begin as soon as possible with the first step being outreach to fleet customers. Doing so will ensure that infrastructure is sized appropriately for fleet loads, minimize cost, and ensure that utilities are able to take advantage of the opportunity to serve this important new class of customer.

Major Fleet Electrification Commitments

- FedEx will replace 100% of its pickup and delivery fleet with zero-emission vehicles (ZEVs) by 2040. FedEx Express purchases will be 100% electric by 2030.

- Amazon expects to have 10,000 custom electric delivery vans built by Rivian on the road by 2022. A total of 100,000 of these vehicles will be in service by 2030.

- UPS has also ordered 10,000 electric delivery vans from the UK-based start-up Arrival.

- Several utilities (e.g., Duke Energy, Exelon, AEP, Xcel, PSEG, Alliant, and CenterPoint) plan to replace 100% of their light-duty vehicles by 2030.

- President Biden signed an executive order directing federal officials to develop a procurement plan that will transition the 645,000 vehicles owned by the federal government to ZEVs.

- New York City will transition to a 100% electric fleet by 2040. Los Angeles Sanitation & Environment will transition all refuse trucks to ZEVs by 2035.

Conclusion

Electrifying vehicle fleets will present both challenges and opportunities for electric utilities. Due to the potentially large, concentrated, and variable loads, it is critical that utilities engage fleet managers and cultivate partnerships with fleets early, even before they begin to plan for electrification.

In particular, utilities should consider collaborating with fleets to determine and optimize EV-charging requirements and assess the capacity of the electric system to facilitate charging infrastructure decision making. Many fleets will require guidance on how to calculate their energy needs under electrification, and utilities have an interest in facilitating those conversations. Consideration of charging costs, rates, and managed charging strategies should also be part of the fleet-utility dialogue.

Over the next decade, as EVs achieve cost parity with ICE vehicles, fleet electrification will increase exponentially driving EV adoption. To ensure cost-effective and reliable infrastructure build-out and management, utilities and commercial customers will need to engage one another in the planning and decision-making processes. Without the proactive approaches described above, fleets and utilities may end up with charging infrastructure that is unnecessary and cost prohibitive, turning fleets away at the early stages of fleet electrification. Together, utilities and their fleet customers can accelerate the adoption of EVs while managing costs to all customers.

How ScottMadden Can Help

ScottMadden works with utilities to plan for the integration of EVs into their business and operations, including the development of EV-charging programs, EV organizations, distribution planning and new business processes, customer outreach programs, and charging incentives. ScottMadden has helped our utility clients develop fleet advisory frameworks and EV-infrastructure programs. In addition, ScottMadden has advised EV original equipment manufacturers and commercial fleets in the development of EV-charging strategies.

To learn what actions your company might be able to take to facilitate the electrification of your fleet customers or begin your own fleet electrification or advisory program, contact us today.

[1]https://www.caranddriver.com/news/a36152896/gasoline-cars-banned-2030-washington-state/